#35 Mini-Essays Part III

On problem solving, angel investing, and the benefits of being permission-less

Happy Thanksgiving everyone. I hope this latest batch of mini-essays will provide some inspiration (or just kill time if you’re traveling) for making 2023 a year to remember. I’m planning to write about modular architectures in blockchains in early Dec — stay tuned!

14. Web Browsers in Web3

I’ve been noodling recently on how the modern web browser might evolve in a web3 world. Until a new form factor that’s superior to the phone hits mass market, I believe we’ll still interact with browsers in a 2D, touch-based manner. Some of what already exists (e.g. single sign-on, payments) will improve via different rails. However, what’s really interesting to me is how web3 might open up brand new engagement models such as:

Hyper-customized experiences based on your on-chain activity

Advertisers can offer way more dynamic experiences via abiliy to pay you (vs. only website)

Ability to directly engage with protocols (such as Farcaster) vs. only clients/APIs

Bookmarks/history/potentially even caching stays with you and is private via ZK (not on local storage)

Ability to tip websites for useful content (similar to what Mirror supports)

What else am I missing?

15. Pendulums

The best way to think about how change happens is a pendulum. Things go one way, people become convinced the future has arrived, and then inevitably, things go back the other way — and repeat. There’s a caveat with this: when things go back the other way, they don’t go back to the same exact state they were before. Rather, they go back towards a state that is similar but upgraded with context & learnings when the pendulum was elsewhere.

We see this happen everywhere. In politics, everyone was convinced in 2008 when Obama won that demographics would forever tilt the electoral map towards the Democrats, and then 8 years later, Trump was in the White House. And then we saw the pendulum begin to swing the other way in 2018 with the largest amount of women ever elected to Congress. In media, streaming supposedly represented the big unbundling of content from cable, but we’re already starting to a re-bundling of content with YouTube TV or Disney/Hulu.

Where might we see this next? In 2021, everyone was convinced that the future of apps would exist on monolithic, fairly centrally managed chains such as Ethereum and Solana. We’re now starting to see a shift towards application-specific blockchains with builders wanting to optimize for their use case. In AI, everyone is convinced the future of creativity will largely come from machines and it’ll be glorious, but I suspect that within the next couple years, there will be a strong push for things that “made with <3 by a human”.

Tick tock, tick tock.

16. Digital Identity

Back in the day, if you switched your cell phone carrier, you had to change your phone #. Because this was so painful given how core your phone # is to your digital identity, network carriers enjoyed “lock-in” effects. People were fine dealing with higher prices and worse service to not have to switch #s.

I’m not sure what exactly happened, but one day all of a sudden, you could switch carriers and keep your phone number. In many ways, you now owned your phone number (as long as you were subscribed somewhere). Not only was this better for user experience, it also brought down cost and improved service as carriers had to compete for customers.

Today, most of us are locked in to our digital identities, whether its Gmail, Twitter, IG, or TikTok. This digital identifier isn’t portable across ecosystems and you have to suck it up when things change in your ecosystem that you don’t like (e.g. Gmail’s new design 🤮 or when the feed algo changes). Web3 introduces the ability for folks to own their digital identity (e.g. ENS/NFTs) and use it across apps. This is additive for users to utilize their personal brand across many different applications without switching costs — but will also be additive to applications who can create more personalized and custom experiences for its “new users”, who won’t technically be new (as they’ve been using other apps in the ecosystem).

17. MEV for Dummies

If you’ve been following crypto, you’ve probably heard of MEV — and then immediatley lost interest b/c it’s confusing AF to understand. IMO, the best way to explain it is not to unpack the acronym (you can Google it) or get into the guts of crypto-economics. Instead, I’m going to borrow how Tarun Chitra (founder of Gauntlet) brilliantly described it in a recent podcast using how digital ads in web2 work.

Google and Facebook both own complex, closed-box algorithms that determine which of the competing advertisers for any specific ad placement, win. This algo is incredibly valuable because of where it sits in the decision-making process and is continually tweaked by Google/FB respectively to maximize value. This is MEV. In crypto, the job of deciding which transactions “win” block space is done by miners/validators vs. a company — but the analogy still holds. Because of where validators sit in the decision-making process, they can decide which transactions win and which don’t — and maximize value (via gas/fees) as a result.

MEV isn’t something new in crypto (although crypto may offer a new way to solve it by decentralizing the decision-making process). It’s all around us and ultimately, an inevitable part of decision-making.

18. Angel Investing

I’m gonna preface all this by saying I’m still slowly growing my angel portfolio and have SO much to learn. However, a few folks have recently asked me what the hardest thing about angel investing is. And yes, getting to a place in life where you have extra capital to invest in super-risky and illiquid investments takes time. But to me, the hardest thing is getting good deal flow.

What does good deal flow even mean? To me, it’s being able to see & participate in every deal. Yes, there’s noise, but you’ll be able to quickly triangulate around larger trends that are being worked on + hone your filter to identity thoughtful projects and founders vs. the opposite, good terms vs. bad ones, etc. The best angels and biggest VCs have access to literally every deal.

So how does one get access to good deal flow? The answer to this is counter-intuitive. You might think its to hustle on Twitter/FC, go to tons of conferences, and sell yourself. And there’s some value there. But what I’ve found the most valuable is to be truly helpful with no expectations. Figure out what you’re good at, go deep on their product and provide value. It can be giving deck/fundraising feedback b/c you’ve done that before, providing technical or product strategy, helping with GTM/growth, intros to other angels/VCs, or something else. Once you do this for a few founders (esp if you’re sector-focused), word will spread quickly as founders always ask “which angels should i want on my cap table?”. And that answer over time will be = “you”.

IMO, angel investing is as much about being a build partner than getting a check in. Do the work.

19. Why “web3” is ngmi

It’s time for the term “web3” to be retired. Why?

Because web3 inherently implies that it’s an upgrade on all things web2: a new paradigm of technology that’s clearly better than what exists today. Building from this starting point has two negative implications IMO:

Needlessly antagonizes successful web2 builders

Products are designed specifically for crypto-native users because the assumption is that every user will eventually become one.

We need to move away from thinking about “web3” as some new-age paradigm and instead view crypto as providing net-new capabilities to the builder’s toolbox. The important piece: these capabilities by themselves don’t matter to users. Users aren’t clamoring for digital ownership, composability, or censorship resistance. That’s just the web3 echo-chamber many of us live in. Rather, we need to create better experiences that are able to compete and win over user mindshare. The same way that users don’t care if your product is powered by AWS or Azure, they won’t care if it uses a centralized database or blockchain.

Bear markets bring out the crypto-haters in full-force. Instead of debating them, we need to empirically showcase the power of what crypto capabilities bring to the table — for users. The future of crypto depends on it.

20. Old vs. New

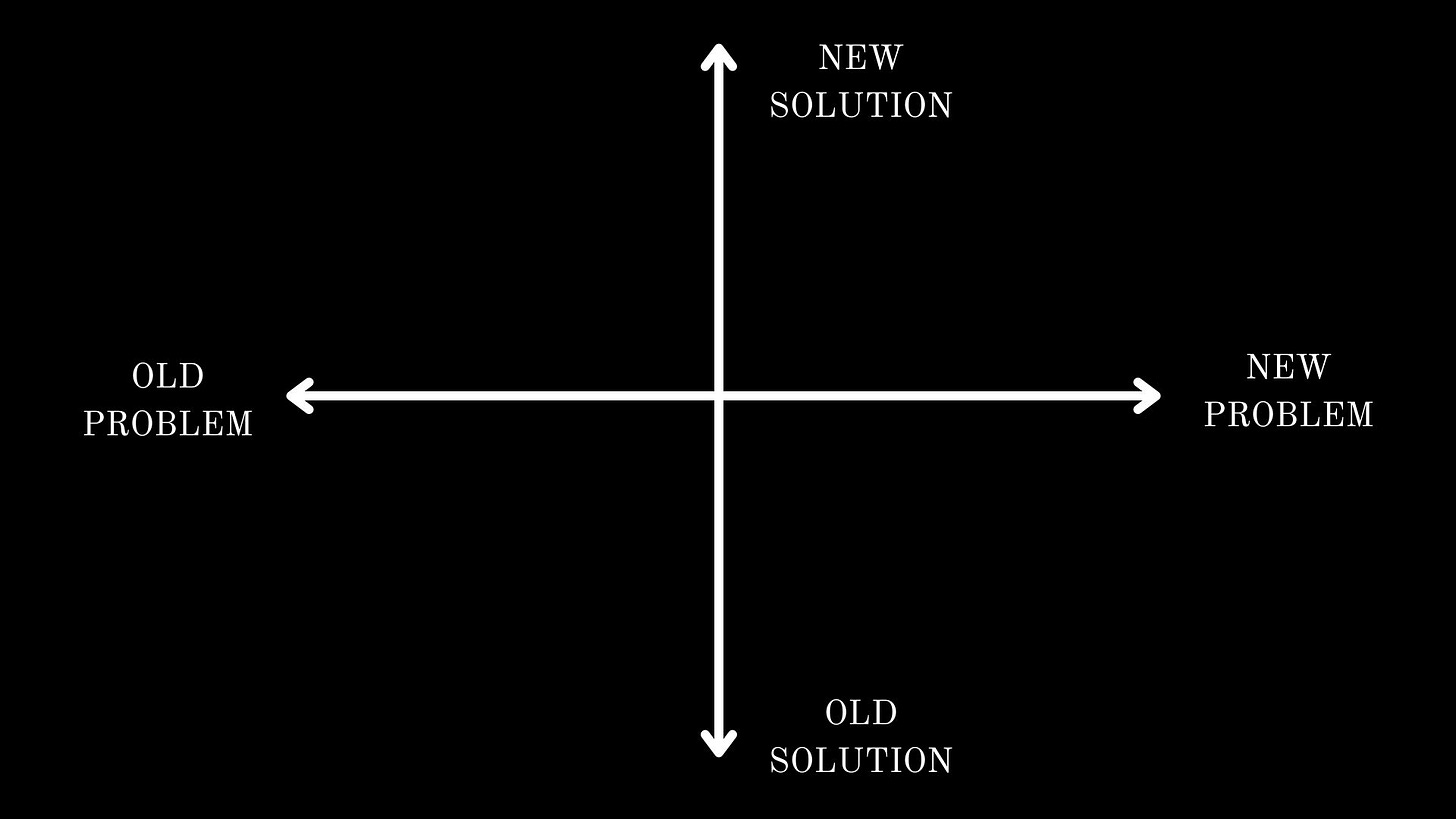

Startups are hard. There are a million ways to think about product strategy and GTM. One of my favorite frameworks to help distill and focus your energies is what I call “Old vs. New”

The idea is to quickly identify if 1) you’re tackling an old or new problem, and 2) if you’re using an old or new solution. This simple breakout turns out to be quite helpful in shaping your next steps. Building electric vehicles (new solution for old problem)? Study what strategies car companies used 50 years ago to gain market share. Aggregating streaming services as a bundle (old solution for new problem)? Learn what cable companies did here and what worked / what didnt. Trying to build AR for metaverse interaction(new solution for new problem)? Prob best to experiment relentless and iterate quickly until you figure out what you want. Using an old solution to an existing problem? Better be sure your solution is 10X more effective than what’s out there.

21. Permissionless

Hang around web3 builders or investors long enough, and you’re bound to hear this word: permissionless. I mean, it sounds good (as a kid, wouldn’t it have been awesome to not need your parents to sign a permission slip?) — but wtf does it actually mean!

To me, the best example of permissionless (and the innovation it can breed) is Google. Back in the 90s, the web was largely permissionless (thanks to HTTP and other open protocol): anyone could access them. This is the reason Google exists — permisionless access provided Google the means to index the web and then implement its magic to build one of the biggest innovations of the modern era.

The reason permissionless is thrown around a lot is because open access to data enables innovation from a wide array of builders (in contrast to some of the massive but largely closed-off ecosystems that exist today). In many ways, its similar to a government enabling the free market to innovate vs. trying to do it themselves. In crypto, because data on-chain is accessible to all, anyone can build (or “compose”) experiences on top. You’re seeing this on Farcaster, the rise of Dune wizards, wallets, DeFi products, NFT experiences, and much more. Innovation FTW.