#7 Programming Art

Join the 264 readers (+19 since last week) of HAX Weekly who are setting themselves up for the future by learning all things crypto + the metaverse and subscribe below.

🎧 To get this edition straight in your ears, listen on Spotify and subscribe to the podcast.

1 Concept 💡

“Generative art has been looked over by the art world and I think as our society becomes more and more technologically inclined, they’ll start to appreciate it much more. The reality is that culture and arts have been quite removed in many ways from the engineering genre…and now we’re starting to see those converge”

-Dmitri Cherniak, generative artist

This week’s concept is generative art, a space I’ve been diving deep into recently and really excited to talk about. We’ll explore what it is, why it matters, and how to participate + invest.

What is Generative Art?

Generative art is digital art generated by a software algorithm. Algorithms are typically rooted around a set of rules while allowing for randomness. Unlike traditional art, this enables an artist to create a collection of hundreds (or thousands) of unique art pieces around a concept. For example, an artist could implement code around a concept of circles with 1) a rule that governs circles cannot overlap with each other, and 2) a set of attributes including number, placement, size, and color of circles to be randomly decided when the code executes. This results in every piece having the same aesthetic (circles!), but the flexibility for one piece to potentially have 5 small circles that are red and blue bunched up near the top, and another to have 4 large black circles at each corner. The magic is that no one knows — not even the artist — what will be generated. The more sophisticated the algorithm, the more likely each generated piece will be of high quality and unique.

If it feels like I’m talking Greek, don’t worry - I felt the same way and got your back. You know what’ll help? Let’s look at some real life examples together...

Derek Edws does a fantastic job laying out the history (and future) of generative art in his piece here, and as he points out, CryptoPunks is the right project to begin our exploration. As you see above, CryptoPunks are rooted around a concept of facial avatars that pay homage to the London’s early 70s punk scene. Additionally, they have dozens of attributes all listed here including type (male, female, zombie, alien, ape) and others such as pipe, eyepatch and VR goggles (all seen above). Each CryptoPunk was randomly generated in 2017 and is unique. What makes CryptoPunks *special* is that its the original generative art project that married itself to the blockchain: all 10,000 pieces are represented as NFTs (see edition #2 to learn what a NFT is). This marriage gives generative art magical super-powers most notably:

Fixed Supply - The artist hard-codes the maximum supply of pieces to be generated in the algorithm before publishing it to the blockchain. This means that no one — again, not even the artist — can change it. And as we all know, fixed supply + growing demand = 📈.

Ownership - Each piece is publicly accessible but privately ownable, storable on a wallet and can be traded.

Rarity - Because all pieces are publicly accessible, it’s possible to determine which the rarity of all attributes. These attributes could either have programmatically been made rare by the artist or by chance. And in projects with a more simplistic concept such as an avatar, rarer attributes typically correlate to higher prices. For example, only 9 of the 10,000 crypto punks (.09%) are aliens, which are the most expensive pieces (current selling price is 35,000 ETH or ~$105MM USD 🤯).

CryptoPunks has led to hundreds of other avatar-style copycat projects, from Bored Apes as part of BAYC to cats, dogs, bombs and every possible thing you can ever imagine. Because there’s so much hype in NFTs at the moment, you see multiple projects launching every week that allows users to generate (or “mint”) up to 10,000 pieces, each for typically less than 0.1ETH (~$300) - and have them sell out in hours or sometimes minutes. Then there’s a scramble in the secondary market on sites like OpenSea where people look to buy, hold, or flip based on rarity, market sentiment, and project roadmap (more on investing in this space below).

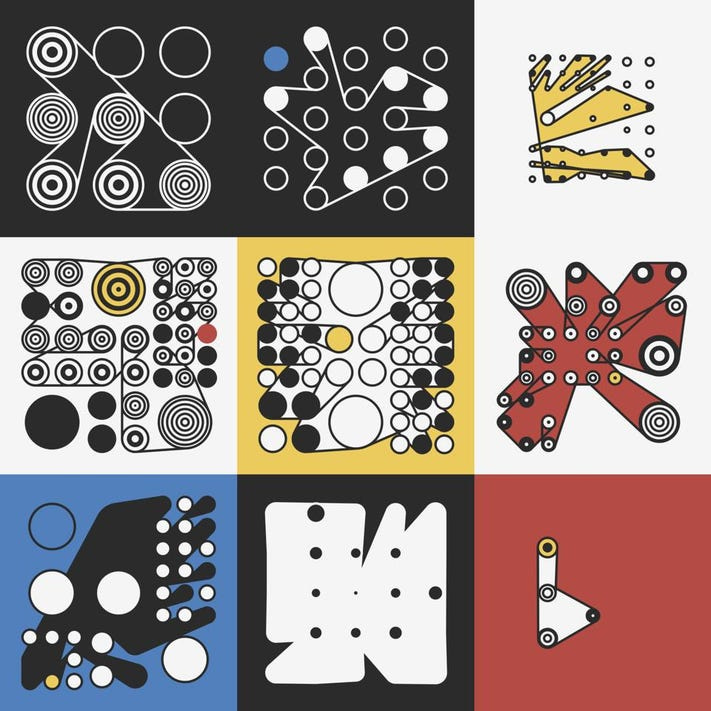

Beyond avatars, there’s another genre of generative art that more closely resembles the aesthetic of traditional art. Here, artists define the geometric structure, shapes and contours and use randomness with much greater sophistication than our circles example at the beginning to create a richer, more diverse set of pieces than avatar attributes. Two of the OG collections in this genre are Fidenza created by Tyler Hobbs and Ringers created by Dmitri Cherniak (whose quote is at the top). Check them out in all their glory below.

As you can see, each is rooted in the same concept but the variation between pieces is wide and beautiful. And price has gone from expensive to INSANE in the past few months: in June, the “floor” price (cheapest ‘buy now’ offer from a seller) for a Fidenza was 6E (~20K USD) which people thought was crazy. Fast forward 3 months later, and Fidenza’s floor is 162 ETH (~$486K USD), a 27X return!!

Why generative art is here to stay

Let’s set price aside for a sec and talk about why generative art is here to stay. To do so, let’s understand why generative art is a win-win for both artists and collectors:

As an artist, generative art gives you creative and financial power over your art like never before. Artists maintain full autonomy over their “digital canvas” by controlling the rules of their software algorithm and deciding where randomness can (and cannot) be injected. However, instead of pouring their energy into creating one physical piece (and then trying to sell it for a sizable price to a small set of collectors), they can express their inspiration via software that generates thousands of digital pieces and sell each for a much lower cost to any internet citizen - often making much more in the aggregate. Further, the blockchain not only allows them to provide a fixed supply which makes the pieces more valuable, it also enables the artist to earn royalties in perpetuity for all future sales. It accomplishes this by adding code in the NFT to take a royalty (typically 5-7.5%) from every sale and send it directly to the artist’s wallet. So, instead of Picasso’s family never seeing a penny of his art’s subsequent sales, the artists of Fidenza and the Ringers for example have each made millions of dollars in royalties for their artists - and rightfully so! I predict we’ll see more and more generative artists doing this as a living vs. a side hustle.

On the collector side, there are several advantages to generative art. First, it opens the door for anyone with a digital wallet to be a collector — and not just something only rich people can partake in. There are really cool tools like Cyber that allow you to create a digital gallery to showcase your collection (check out my budding gallery). The other big advantage is leveraging the power of brand and community. Unlike, stand-alone physical pieces of art, generative art collections are owned by thousands of individual collectors. This opens the door for all sorts of ways for collectors to benefit including 1) collector-only perks (Bored Ape Yacht Club has both an incredible roadmap which provides special benefits to members and a community that is ride-or-die for its members), and 2) become “1 of 1 of X” owners. With generative art, owners own a unique piece of art (1 of 1) but belong to a broader collective brand like Fidenza. Everyone who owns a Fidenza is incentivized to make the brand as powerful and valuable as possible - and as Fidenza’s become more sought after, every collector benefits.

Ok, so how do I participate and/or invest?

If you’re artistic, I suggest checking out P5.JS, which is a coding tool that allows you to create algorithms to create generative art. There are plenty of examples + tutorials available on the site. Side note: my sister-in-law Nisha makes amazing fractal-based art (check out her pieces here!) and so when she came to visit NYC last week, we both agreed that her next piece of art will be generative. Let’s all cheer her on and I’ll be sure to share it. She’s just getting started learning P5 so if you’re in the same book, reply to this email and I’ll put you guys in touch.

As an investor, I’ll lead off by saying nothing below should be taken as investment advice. It is merely my opinion. At a macro level, I still believe the NFT market is quite overheated and the best thing to do is learn the space. When people aren’t talking about NFTs daily is probably the best time to invest. On the avatar genre, the best way to learn is to join Discord groups for any projects you’re interested in and gauge the community and roadmap delivery. Is the community active / are they helpful / or do they just talk about price 24/7? Do the project leaders have an audacious roadmap and are they generally delivering against it, or are they never heard from after initial sale. These two will give you a strong indication of the future staying power. My 2cs is that the OG projects in this space (CryptoPunks, BAYC) are here to stay and are great long-term investments, although potentially not at these prices. As I’ve mentioned before, I personally want to see what happens to NFT prices if/when Ethereum rises in price before making any sizable investments.

On the Fidenza/Ringers side of the house, ArtBlocks is currently 👑. ArtBlocks curates the most sought-after generative art projects (including both Fidenza and Ringers) and allows members to mint them on their site. I strongly recommend checking out @Zeneca_33’s piece on why he believes that much of the value in this space is in Artblocks and which collections he recommends looking at (including starter pieces you can buy for <1 ETH), and also joining the ArtBlocks Discord server here. ArtBlocks isn’t the only game in town - there are several other generative art communities popping up including Gen.Art (disclaimer: I’m a very happy member) whichj offers a NFT-based membership to mint art from artists they hand-pick. The Discord is a extremely friendly place so join us here!

So whether you want to program art or invest in programmed art, I personally believe we’re in the first inning of generative art, that it will be a multi-billion dollar asset class, and now is as good as a time as any to get involved. Just don’t be a spectator.

2 Themes On Our Mind 🤔

Shameless plug: HAX announced yesterday our latest vision of educating 10MM+ young ppl on how to invest and participate in crypto through our “learn to earn” community which allows members to learn and earn $$ while doing so (see tweet below for more details). We’ll be helping members learn the space while also building some really cool shit like NFT-based membership, investing simulations and $HAX tokens. So if you’re crypto-curious, interested in helping us build, or want to keep up-to-date, please join our Discord server here. It’s starting to pop!

The last few days have been BRUTAL for crypto 📉 - we saw drops of ~25% (Bitcoin hit $40K and ETH went down to $2800 last night!). This pain was also felt in other asset classes including stocks. The source of this drop seems to have come from Evergrande, a Chinese property developer that was unable to pay back debt. If they continue to be unable to pay back their debt, that could have cascading effects to the global economy and makes investors leery of putting their $$ in risky assets, crypto often deemed the “riskiest” among them (Sahil Bloom does a great job here explaining Evergrande in detail).

From my experience, I’ve learned that whenever there is general Fear, Uncertainty or Doubt (FUD) in the market, crypto gets hit the hardest. However, if it’s not crypto-specific (e.g. some issue with the sector or a particular cryptocurrency), you should look at it as an opportunity to buy on sale. Assuming you believe in crypto as much as you did 3 days ago, shouldn’t you be happy that you can buy at a 25% discount? However, if your belief is fully predicated on price, I strongly suggest you figure out a way to change that and build more conviction (this newsletter is a great place to start!) - otherwise, you’ll go insane! Again, not investment advice.

3 Things To Check Out 🔍

Really enjoyed this piece by Packy McCormick on what “Bezos Crypto” would do. The idea is that Jeff Bezos jumped into the internet because of its massive growth + potential and built one of the world’s most valuable companies (Amazon). Today, a 25 year old Bezos would probably jump into crypto/web3 given similar growth and potential - so, what would he build?

Forgot to mention this last week, but Cathie Wood (famed investment manager behind all ARK funds) is quite bullish on crypto and predicts Bitcoin to hit $500K in 5 years (see here and also listen to her below on the Bankless pod). Never take price predictions as truth, but do listen to the rationale of the people who make them and how they believe the future will unfold.

Finally, much of my inspiration for this newsletter came from the podcast Dmitri Cherniak (artist of the Ringers) did with Kevin Rose. It’s a must-listen on Dmitri’s inspirations, his early days playing with ASCII art, how he thinks about the space and much more.

Until next week, always be learning

Karthik